Mayor Dyster doesn’t look too happy presenting his 2018 proposed budget at Niagara Falls City Hall, which raises taxes on residents and businesses.

While the national and state economies have enjoyed a reasonably robust recovery in the years following the housing meltdown and great recession, the financial condition of the city of Niagara Falls has steadily deteriorated over the decade Mayor Dyster has been in office, and there’s no mystery why.

Rock concerts, Winter Fests, a Dairy Queen drive-thru, Totes McGoats, a Discover Niagara shuttle devoid of passengers, a woman hanging by her teeth – those are just some of the silly things that Mayor Dyster has seen fit to throw money at.

There are also the across-the-board City Hall salary increases he handed out last month in the face of casino funds disappearing, a slapdown by the State Comptroller’s office for fiscal mismanagement and a downgrade of the city’s credit rating by Standard and Poor’s.

Not to mention the 200 big ones a year it’s costing the city to heat and air condition, clean the bathrooms, mop the floors, wash the windows and provide near round-the-clock security for the chronically underutilized and overbuilt new Niagara Falls International Train Station.

“While some of what I present to you tonight may be difficult to swallow,” the mayor said last week, presenting his 2018 budget that raises taxes for both residents and businesses 2.6% and 14%, respectively, “I assure you it is a considerable improvement over some of the alternatives we’ve been forced to explore in past weeks.”

That’s one clue as to why the city’s financial outlook is in the sorry shape it’s in. Mr. Dyster’s budgetary time frame is “weeks.”

“City officials did not develop a multiyear financial plan,” read a recent audit of Niagara Falls released by the State Comptroller’s office, “For example, such a plan would have shown the magnitude of the impact of the loss of the casino revenue and provided a tool to assess the impact of different approaches to using the balance of the funds on hand.”

“This may have mitigated the City’s declining financial condition.”

The fact is, the day Mayor Dyster took over from Mayor Anello, on Jan. 1, 2008, the city had an $8.5 million surplus and $38 million dollars of casino revenue on hand. All gone, or soon to be.

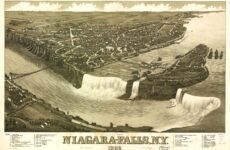

Ten years the mayor has been at the helm, presiding over the painful decline of an internationally-known city, a city blessed with millions in casino revenues, that receives nearly a million dollars annually from the NYPA hydropower plant, next door to a state park that welcomes over eight million visitors a year. All revenue sources that most cities would give their eye teeth for. And yet, the city still struggles.

“(The council) has chosen to use casino payments, rather than raise taxes, to pay for the same expenses,” contended Mr. Dyster in a TV interview, attempting to shift responsibility for his city’s predicament to the City Council.

Of course, preparation of any government budget is an executive branch function. Simply put, the mayor creates the budget, submits it to the council for amendment and approval, and then signs the result. So actually, the mayor has two cracks at it, the council, one.

Deflecting blame from himself for misusing casino funds, papering over a decade of fiscal mismanagement, assigning sole responsibility for many millions of dollars of wasteful and profligate spending to the City Council – these are the cynical strategies employed by Mayor Dyster, whose BA and Masters degrees were not in any technical or business field, but Political Science.

If you had spent the first six years of your adult life studying Political Science, you’d probably be able to figure out how to be mayor, too. You’d have picked up all the skills that Mr. Dyster has: how to shift blame, shade the truth, straddle the issues, play upon people’s aspirations, promote your cronies and trip up your opponents, all the time projecting an image of competence and integrity.

It’s also too bad they don’t teach basic math in Political Science school, when you consider what the mayor said next.

“…had the city raised local property taxes to the state constitutional threshold year over year,” he said in his budget presentation, expressing one of his deepest desires, “the city would have an additional $9.6 million at its disposal,” as reported in the local daily.

Clarifying, the mayor stated “The good news is that… since 2012 about $9.6 million that might otherwise have been collected as property taxes and gone into city coffers to help offset rising expenses has instead remained in the pocketbooks and bank accounts of city residents.”

The city has been using around $9 million of casino money every year to balance the budget since 2012. That’s approximately $65 million total to date, including the proposed 2018 budget, which actually calls for a diversion of over $11 million of casino funds.

Therefore, casino funds over the years have saved taxpayers from paying $65 million, not $9.6 million, of Mayor Dyster’s bloated budgets.

In bemoaning the lost opportunity, as Mayor Dyster appears to view it, of raising taxes to the constitutionally-allowed limit, which only would have amounted to an additional $1.3 million annually since 2012, he is attempting to portray his upcoming tax increase as reasonable, and a done deal. It may well turn out to be, with the city facing insolvency and a compliant City Council at his beck and call.